Financial Literacy

1. Money is a universal language, but its value is understood differently across borders.

2. An investment in knowledge pays the best interest.

Financial Literacy - Activity 1

Money is a universal language, but its value is understood differently across borders.

Classes: XI & XII

Exploring Global Currencies: A Journey into Financial Literacy

As part of the international project Financial Literacy – Decode the Money Code, the school hosted an enriching session for Classes XI and XII. The programme was designed in collaboration with partner schools in the UK and Japan, and further enriched with perspectives from the UAE, China, and India. This cross-cultural exchange gave students an opportunity to view money not only as a medium of exchange but also as a bridge connecting economies, cultures, and everyday lives across the globe. During the session, students engaged with a presentation on world currencies and currency conversion, which brought to light the dynamic value of money across different nations. They discovered how exchange rates influence international trade, travel, and daily transactions, linking classroom knowledge directly to real-world applications. The interactive nature of the session encouraged students to compare, question, and reflect on the role of financial literacy in an increasingly interconnected global economy. The event served as the first step in a series of activities under the project, setting the foundation for a broader understanding of finance that is not only academic but also practical, cultural, and global in scope.

Learning Objectives:

- introduce students to the concept of global currencies and exchange rates.

- link classroom knowledge of economics with real-world financial practices.

- highlight the importance of financial literacy in international trade and travel.

- build awareness of how money functions differently across countries and cultures.

- encourage students to think critically about financial systems beyond their nation.

- foster curiosity and respect for diversity through global financial perspectives

Learning Outcomes:

- Students gained an understanding of global currencies and their conversions.

- They learned to appreciate how exchange rates affect trade, travel, and everyday life.

- They developed the ability to connect classroom economics with real-world practices.

- They became more confident in approaching financial matters with awareness and adaptability.

- They recognised the global nature of financial systems and the value of cultural perspectives in money management.

--------------------------------------------------------------------------------------------------

Financial Literacy - Activity 2

An investment in knowledge pays the best interest.

Class XI & XII

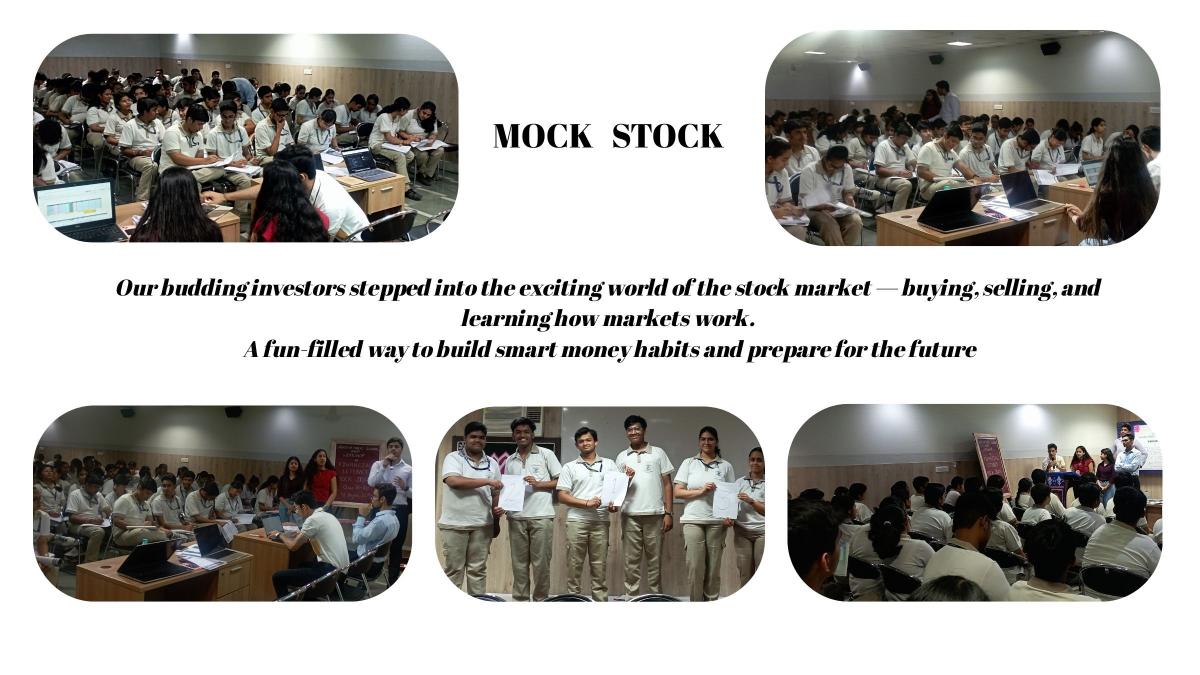

Mock Stock: Turning Classrooms into Trading Floors

In a lively blend of classroom theory and real-world practice, students of class XI and XII recently stepped into the fast-paced world of a simulated market, where lessons leapt off the page and into action. The high-energy buzz of a stock exchange during the school’s first-ever Mock Stock event brought financial concepts to life in the most dynamic way possible. Working in teams, the students stepped into the roles of traders, each starting with a virtual capital of ₹10,00,000. Their challenge was to buy, sell, and even short-sell shares of seven fictional companies, along with trading three commodities: gold, silver, and crude oil.

The event was a part of the Financial Literacy – Decode the Money Code initiative. the simulation aimed to build not only financial knowledge but also the ability to make informed and responsible economic decisions. Over three fast-paced rounds, the market price shifted swiftly based on breaking news and market rumours,” forcing participants to adapt strategies on the fly, analyse data quickly, and work closely with their teammates.

The experience brought classroom lessons to life, connecting them directly with the hustle and excitement of real-world markets. It not only nurtured a positive attitude towards managing money but also deepened students’ appreciation for economic diversity. Along the way, they sharpened their communication, strategic thinking, and grasp of global financial trends.

By the close of the simulation, generously supported by an alumnus-led company, students left with more than just knowledge. They carried sharper budgeting and analytical skills, stronger teamwork, and a newfound confidence in tackling financial challenges. The shared sentiment was clear: learning about finance isn’t just important; it can be exciting, eye-opening, and genuinely transformative.

Learning Objectives:

- Bridge the gap between classroom knowledge and practical application

- Help students experience the real-world dynamics of trade, budgeting, and resource allocation.

- Develop financial decision-making and budgeting skills in a risk-free, engaging environment.

- Foster critical thinking, adaptability, and collaborative problem-solving.

- Build awareness of market diversity and the interconnectedness of local and global economies.

- Strengthen communication and negotiation abilities through peer-to-peer interaction.

Learning Outcomes:

- Students gained sharper financial skills

- They learned to approach money management with a balanced, informed perspective.

- Analyse and respond to changing market conditions effectively.

- Collaborate efficiently within a team to achieve shared goals.

- Recognise the value of strategic planning and resource optimisation.